Why Was the GST Tax Commenced?

This post was last updated on December 30th, 2024

Under the slogan of “One Nation One Tax” the GST was implemented by the current government which collected both applause and criticism. Before jumping to a conclusion as to why it was an absolute right move or a horrible policy on behalf of the government, it’s best to see understand what was the necessity behind this historic tax reform. Indian government has forced businesses to opt for GST tax and generate GST invoice as per the transactions since years.

Single Tax System

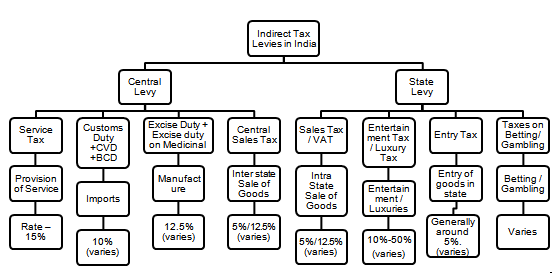

With multiple states and various layers of tax like VAT, education cess, entry tax, etc it was increasingly becoming a pain for businesses to operate smoothly and there were loopholes for exemption. This had to be dealt with firmly to ensure that every business gets a fair chance and the economic growth of the country is also stabilized.

Multiple Tax Systems

The issue that existed before GST rates on services was fixed had everything to do with the multiple tax system. Not only is it extremely confusing for the general mass but at the same time had one tax added on top of another which was greatly affecting the end consumer.

Not only this, but the traditional method had around 17 different taxes implemented by the central government and the state government which would now be calculated under GST.

For Business Growth

The old accounting system was failing rapidly to identify defaulters. With GST the regular-check method is expected to ensure that all such flaws are eliminated. These would not only help businesses keep a regular check on their finances but also lower the pressure on the March financial year-end. If you still don’t know, you can read all the advantages and disadvantages of GST on this blog. Here you can learn more about independent contractor taxes.

Helping SMEs And Micro Firms

For small and medium enterprises (SMEs) and micro firms, the journey towards implementation of GST was uphill. But this actually boosted the growth for all such companies once the tough times were over. This was a calculated risk which was taken into account as the government moved to pass the bill keeping in mind the long term benefits that these MSMEs would recur.

Progressing With Advanced Technology

As mentioned before the old accounting system had its own flaws. One of the main reasons behind implementing GST was also the use of advanced digital technology to keep track of all tax collected and defaulted. This would later go on to help calculate the economic growth of the country and businesses more accurately.

Inter-State Business Opportunities

While discussing the multi-layer tax applicable in different states and its effects on end-consumers, it is important to note that it was also a hassle for businesses. Micro, small, medium and large businesses before faced a strong stringency in terms of doing interstate business.

This occurred earlier due to all the complex layers of the multi-tax systems which were different in the case of many states. To bring this system to equilibrium was necessary for businesses to expand beyond headquarter borders and witness growth.

No Advance Tax

This move also brought a significant change in how businesses operate internationally and nationally. Before this, there were taxes levied on receiving advance payments for supplying goods. With this new imposition, all such limitations were crossed off with an era of ease for doing business. The taxes levied and the slabs relevant to each service are now available as the GST rates chart was introduced in the last budget.

What Is The GST Rate In India?

Before the implementation of GST small businesses were often paying tax returns around a rate of 26.5%. Post-GST this rate has wound up to be 18%. This form of a tax cut would only help encourage small businesses to expand further and engage more in the market.

Tax Filing Is Only A Click Away

Another added feature for which GST was implemented was the user-friendly online system of filing IT. This ensured that defaulters would be easily marked out. Those that avail of this method would benefit in multiple ways by keeping a clear online track of their IT status.

No More Imposition

As one of the main aims was to bring equality in tax and provide a fair chance to businesses for proliferating, it is ensured that no extra cess will be implemented beyond GST. This is not only applicable to the state but also for the central government.

A Reform Without Affecting State Revenue

With the old system failing to incur taxes properly and helping businesses bloom to bring more economic growth in the country, a reform was indeed necessary. One of the key reasons for GST becoming the savior is it wouldn’t affect the state that has a business serving the end consumer in it.

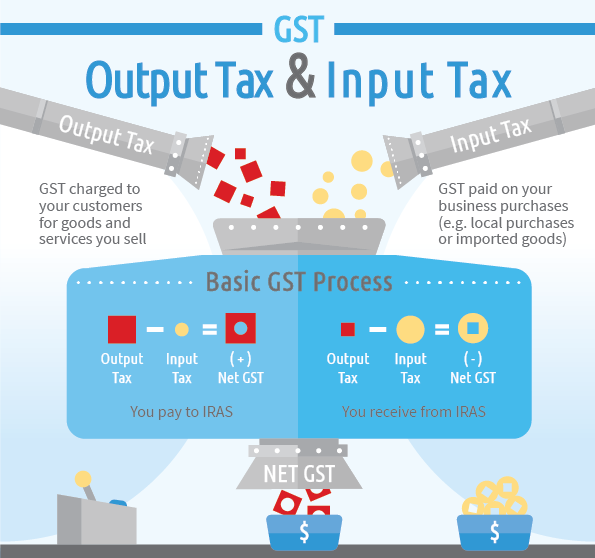

This means that although interstate business opportunities are provided when a good is sold from a manufacturer in state “A” to a buyer in state “B”. The revenue incurred will rest with the buyer’s state. This obviously has the rate divided in CGST (central goods and services tax) and SGST (state goods and services tax) which helps make an accurate distribution of revenue possible for the buyer side state.

Recommended For You

5 Ways To Enhance Customer Experience In Your Practice

Most Inside

Most Inside offers high-quality recommendations and valuable updates to enhance all aspects of your life, providing premium guidance and enriching experiences.