Top Essential Features Customers Look for in Their Bank’s Website

Banks have been around for at least 3 centuries. From granaries that transacted sacks of grains to modern-day banks that take Bitcoin cryptocurrency, the world of banking has undergone an evolution of its own.

Ever since the first banking transaction, there was one thing that made customers use banks as a place to save their hard-earned money. ‘Trust’. It is the trust that their money and assets will remain secure and in trustworthy hands that have made banks into today’s gatekeepers of private and public finance.

With the rapid penetration of Internet and mobile apps, banking has also become a digital exercise. Unlike our ancestors who visited the bank in person for any financial matters, today, customers transact every imaginable transaction through online means. From applying for loans to paying utility bills like electricity, Internet, mobile and so on, they rely on Internet banking to make their lives easier.

But, there is a catch. Anything transacted over the Internet it at risk of being hijacked by cyber-criminals. According to Cyber Security Ventures, “cyber crime damages will cost the world $6 trillion annually by 2021, up from $3 trillion in 2015.” Online banking, which is a lifestyle for the millennial generation is also at risk.

It is high time that banks alert customers how to safeguard themselves while conducting online transactions. Most importantly, they must take upon themselves the responsibility of informing customers what are the most significant traits of a genuine banking website.

This blog is a breakdown on some such features that customers should be instructed to look for in banking websites when making any transaction.

If you are a banker, make sure your IT team preps your website with these features.

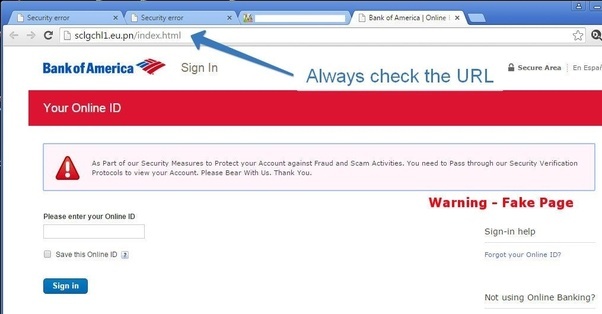

Check the URL

Perhaps the straight-forward way to spot a phoney banking website used for phishing from a real one is the URL structure. If the URL has anything suspicious like wrong spelling, hyphen, additional characters that do not form part of the bank’s original name.

In fact, most banks at the time of issuing the online banking credentials mention the website URL that customers must use for logging in. Ensure that the URL is the same as prescribed by the bank. Using any other website means that there is a heavy risk involved. It could very well be a fake bank website.

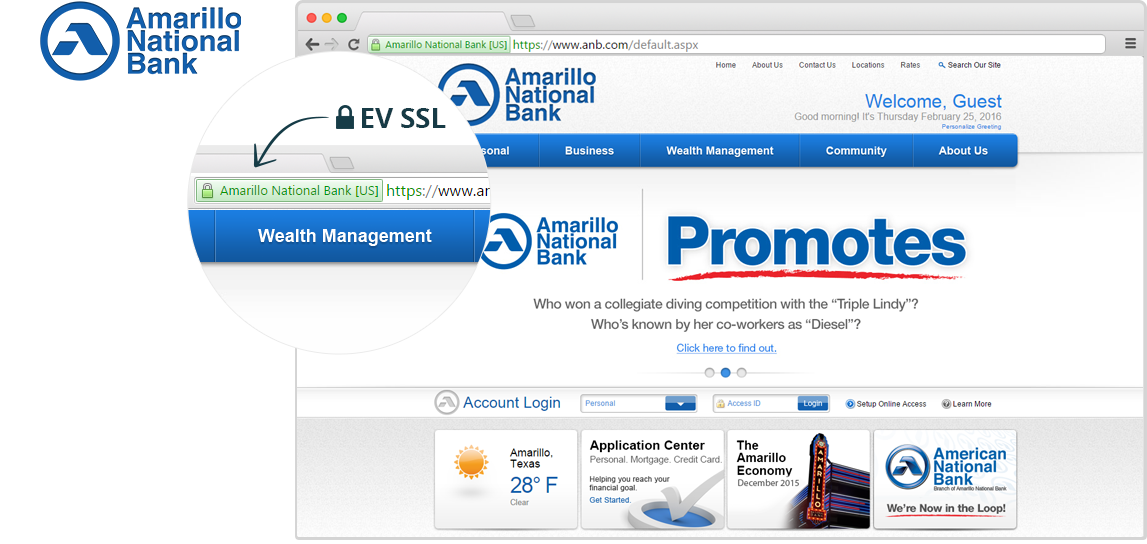

Look for HTTPS

HTTPS is the secured version of a HTTP website. In fact, it is soon becoming the standard for the Internet as Google, WordPress, and several other dominant brands are pushing for a safer web environment.

Banking websites are recommended to take EV (Extended Validation) SSL Certificate; to ensure that customer landed on the exact site. EV (Extended Validation) SSL certificate display the company name, in the browser address bar. It helps to builds trust and confidence in the customer mind. To obtain an EV SSL certificate a business need to verifies, its existence by Certificate Authority through a strict verification process. A large enterprise can obtain EV SSL certificate at an affordable price from a reseller like Cheap SSL Shop. You can view the sample of Extended Validation below.

Clicking on the organization name would show the certificate details. Any customer can instantly verify the genuinity of the bank by clicking on the button and verifying the organization details. The same applies even when the website is accessed through a mobile or tablet device.

Use a Two-Factor Authentication

Two-factor authentication or 2FA is a security system that requires the user to have an additional layer of security, usually a token, a physical key or a One Time Password (OTP) to access an application. The second layer of protection is usually created dynamically, or in real-time upon the request of the user.

For instance, it would be sent to the user when he/she requests to log into the application or requests to transaction an online transaction, like third-party money transfer. The benefit of 2FA is that, it prevents logging in with just one layer of security, that is the username and password. Even if a stranger is to get the username and password, they still not be able to gain access without the second factor authentication, that is the one time password. This ensures that the customer account information remains safeguarded at all times. It also prevents the possibility of transactions taking place without the account holder’s knowledge.

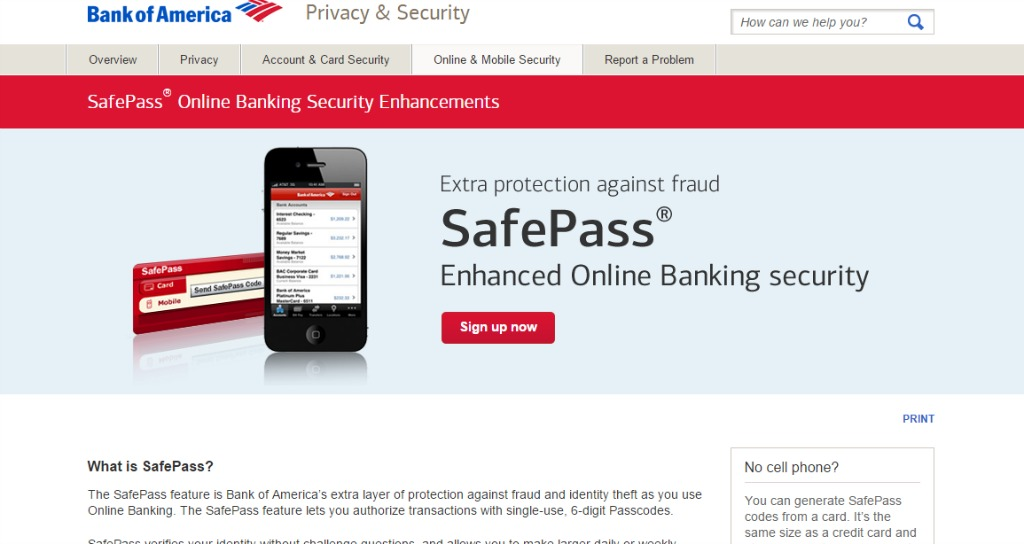

A classic real life example of two-factor authentication is Bank of America’s SafePass. It gives account holders single-use codes for conducting transactions.

Look for Pesky Adverts

Banking websites do not usually advertise, except for their own housing loan, personal loan, deposit schemes and so on. So, if you spot a banking website that runs some other ads, more similar to blogs and websites that rely on adverts as an income, stay alert. It could possibly be a fake website.

In fact, it is recommended not to click on such adverts that could possibly take you to external websites where your information could be compromised. The ideal thing to do would be to alert the bank if you think the website is compromised.

Turn off AutoFill

Autofill can be a godsend when you are bad at remembering usernames and passwords. But, they are not exactly a benefit while using banking websites. In fact, it is better to turn off autofill for banking websites. Imagine the tragedy if somebody else uses your computer and they are able to access your bank account in an instant, thanks to autofill?

Luckily, most web browsers like Chrome, Safari, Mozilla Firefox and the likes come with the option to turn off auto-fill or ‘Remember me’ option for websites. Use that option and safeguard yourself from letting someone else access your bank account.

Wrapping it Up

The Internet is a huge convenience. It makes it easy for anyone to do anything with few taps of their fingertips. Needless to say it has simplified banking to a lot. In a way it has even brought banking to our living rooms. But, there is a cost to be paid for such convenience. It is the risk of cybersecurity.

Banks and customers alike have to make remedial measures to keep data safe. Our pointers should help you do that the right way, whether you are a banker or an account holder.

Recommended For You

Why ELAC Powered Speakers Are Worth Buying

Most Inside

Most Inside offers high-quality recommendations and valuable updates to enhance all aspects of your life, providing premium guidance and enriching experiences.