Choose The Right Insurance Cover For Your Car

Anyone who owns a car is legally bound to have car insurance. You may land up with a hefty fine or even disqualification from driving in the absence of insurance coverage.

So, having your car insured is mandatory, but choosing the right cover that suits your need can be a headache for you.

We are listing the policy types to help you choose the right policy. Every policy comes with its benefits and price. It’s worth considering before buying, how much every cover is costing you. Decide by maintaining a proper balance between cost and benefits.

Don’t buy a policy just for the sake of legal work completion, consider the facts whether you are getting the right protection from the policy on which you are investing money.

The Car insurance policy covers four types:

1. Third Party Insurance Cover

Third Party insurance is the primary car insurance cover. It is the minimum legal cover that you can have. You are not covered in this policy, it covers only third parties means other people.

Imagine you are driving the car, because of your fault an accident is caused, someone else is injured, or other person’s car is damaged. Will it be fair enough other persons pay from their own pockets for damage caused by your fault? Absolutely No.

Third party insurance is made for this situation. It covers damage to others vehicle or property and an injury to other people or animal involved in an accident.

Your own car is not covered in this policy, but if you have crashed into someone else’s property than third party insurance will cover the loss, you owe to them. But the damage to your car or any injuries you have met with will be coming from your pocket only.

2. Third Party, Fire and Theft Insurance

Along with the benefits of Third party insurance, it also includes some extra benefits. Like the third party, you are going to bear the damage cost of your car. But this policy gives extra protection in the form of repair or replacement of your cars.

If your car is damaged by some natural calamity or is stolen, you can claim for policy benefits. Your insurer provides compensation after analyzing the damage severity. If your car is completely demolished you can even get the compensation of same value.

It also covers damage caused as a result of attempted theft like your cars window panes are damaged to steal your belongings from the car.

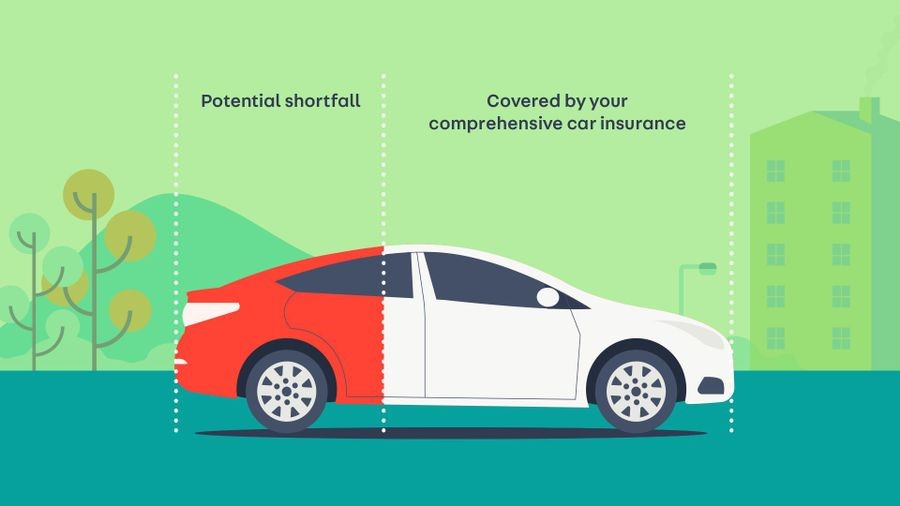

3. Comprehensive Insurance Cover

This is the only insurance policy that covers damage to your car. Even if an accident was your fault, still it is covered in this policy. The fully comprehensive cover also protects you from third party claims.

After an accident, you can claim for repairs, accidental damage and even vandalism. It is a common belief that comprehensive policies are most expensive as they offer most of the benefits.

Well its true, but not always. While comparing prices, it is worth looking at the price difference between comprehensive and third party very cheap car insurance but comprehensive actually works as cheap as third party insurance.

High-risk drivers usually go for third party insurance to lower their insurance cost resulting in a higher number of claims of third-party covers. This leads to raising the overall cost of third party insurance.

It would be worth it before buying a policy, you check the cost of all levels of a policy cover. A Comprehensive policy may fall short in some areas. Never assume that you can enjoy all the benefits, it is better if you check policy details before you buy.

4. Guaranteed Asset Protection Insurance Cover

GAP insurances cover the gap between the actual value of your car and the amount you owe on your car. The moment your new car leaves the car lot, its value starts getting lower. Most of the cars lose even 20 percent of their value within a year. It protects you when you owe more than your car’s worth.

GAP cover gives an assurance that the car loan will not become your financial burden if your car is crashed entirely or stolen. It enables you to get a replacement equal to the car you had.

It is true that car insurance is costly. But if you go for a lower level of cover just to save your money than it might be a false economy. You may buy lower cover now but might end up paying more in the coming future, especially if you met with an accident where the fault might also be yours.

As car insurance is mandatory so choose your plan very wisely. Compare various plans and then buy the policy that is economical for you and gives you better coverage.

Recommended For You

Tips For Recovering From Whiplash After a Car Accident

Most Inside

Most Inside offers high-quality recommendations and valuable updates to enhance all aspects of your life, providing premium guidance and enriching experiences.